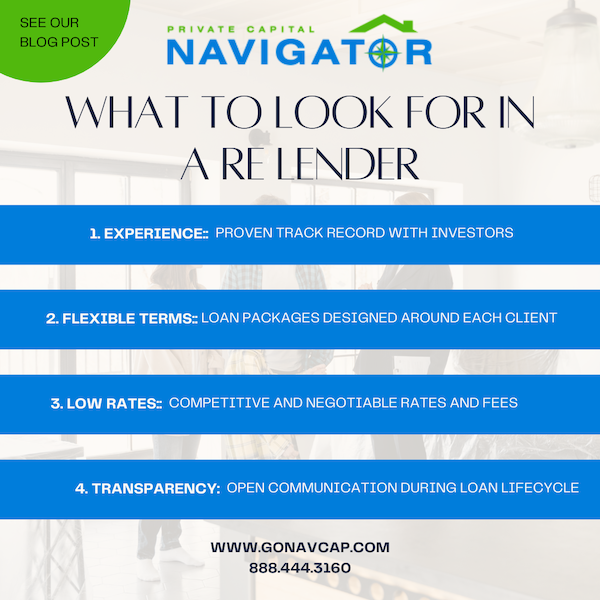

Navigator Private Capital is a private commercial real estate lender whose primary objective is to meet our borrower's need for short term bridge financing.

Copyright ©2025. All Rights Reserved.

What’s that old saying? Nothing in life worth doing is ever easy. That certainly rings true when it comes to real estate investing. While it offers an unparalleled path to wealth building, investing has potential pitfalls that can derail ...

read more