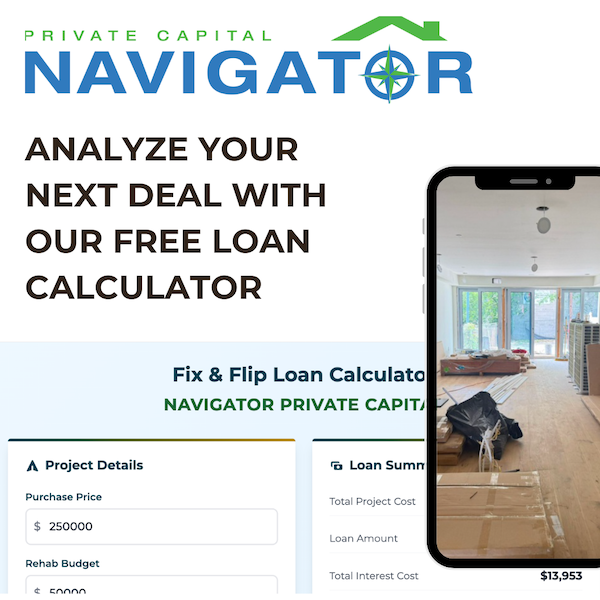

Navigator Private Capital is a private commercial real estate lender whose primary objective is to meet our borrower's need for short term bridge financing.

Copyright ©2025. All Rights Reserved.

There are certain things that our best clients have in common. Learn from their success and start negotiating from a position of strength. 💪

Recently, our rates have become even MORE competitive, starting:

📌From the mid–9s for Fix-and-Flip Loans

📌From ...

read more